19th February 2025

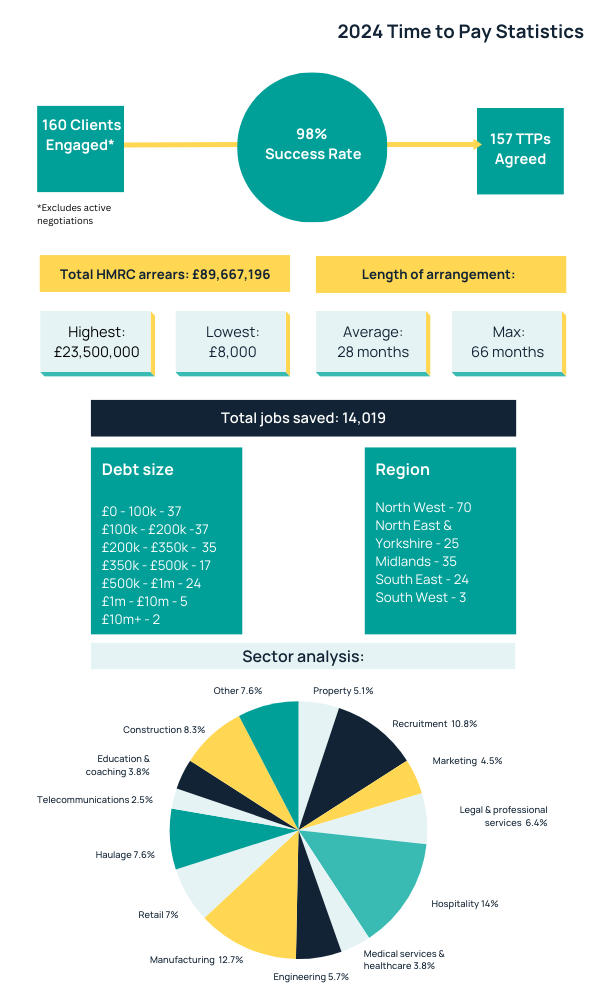

The Leonard Curtis funding team has seen a significant increase in HMRC time to pay enquiries – up 58% compared to 2023 numbers – due to a combination of factors.

There has been a notable rise in enforcement action from HMRC over the last 12 months, which has prompted business owners to take early advice, engaging with both professional advisors and HMRC prior to enforcement action being taken.

Furthermore, with the associated risks connected to secured lending whilst a business has outstanding tax due to HMRC, we have seen an increased requirement from banks and funders for both new and existing clients to have a formal agreement with HMRC.

With debt size ranging from £50,000 to over £10million, these challenges affect businesses of all sizes, taking debt advice early is critical to ensure business survival in a tough economic climate.

The Leonard Curtis team’s exceptional reputation, proven track record and access to multi-disciplinary solutions continues to play a key role in helping clients seeking expert assistance.

To find out more about how Leonard Curtis can support your clients or business when under pressure from HMRC, visit www.leonardcurtis.co.uk, get in touch with your local team, or call 0161 835 1900.